Central Ohio Housing Need Assessment

Jump to housing study key findings.

In 2017, the Building Industry Association of Central Ohio (BIA) studied the region's housing needs through 2050, projecting an annual need for 14,000 housing units based mainly on projected job growth. Since then, the area has continued to fall short of that production target.

In 2022, with continued growth and Intel's arrival, the BIA Foundation commissioned Vogt Strategic Insights to update the housing study. The new Housing Need Assessment shows a need to double previous housing production to meet demands through 2032. Failure to do so will exasperate housing affordability and availability and place Central Ohio's economic growth at risk. The report highlights widespread underbuilding, rising home prices, and rental rates outpacing income growth. It provides data for ten central Ohio counties and aims to inform decision-makers about zoning, land use, infrastructure, and workforce issues.

Central Ohio Housing Report Key Findings

Central Ohio's housing gap is not unique to any county or municipality. The report concludes that, while underbuilding is undoubtedly more acute in some places, the increases in home prices and rental rates have continued far to outpace income growth within all geographic areas of study.

Projected Housing Need:

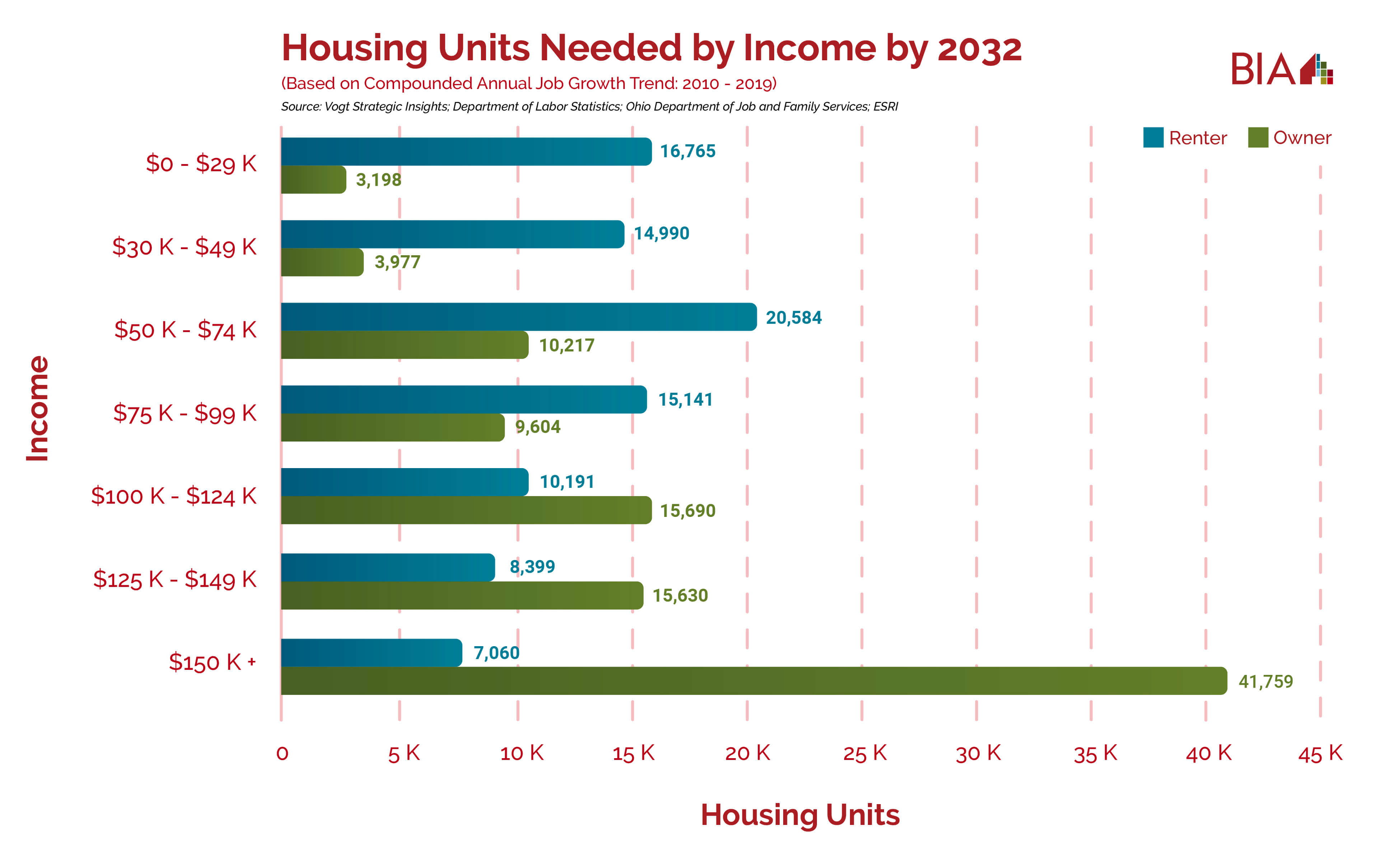

Job growth estimates consider historical employment data from 1990-2019 and 2010-2019.

Source: Vogt Strategic Insights. Department of Labor Statistics, Ohio Department of Job and Family Services.

- The region is expected to gain 145,000 to 202,000 jobs by 2032, necessitating additional housing units.

- For every 100 new jobs, 95 housing units are needed.

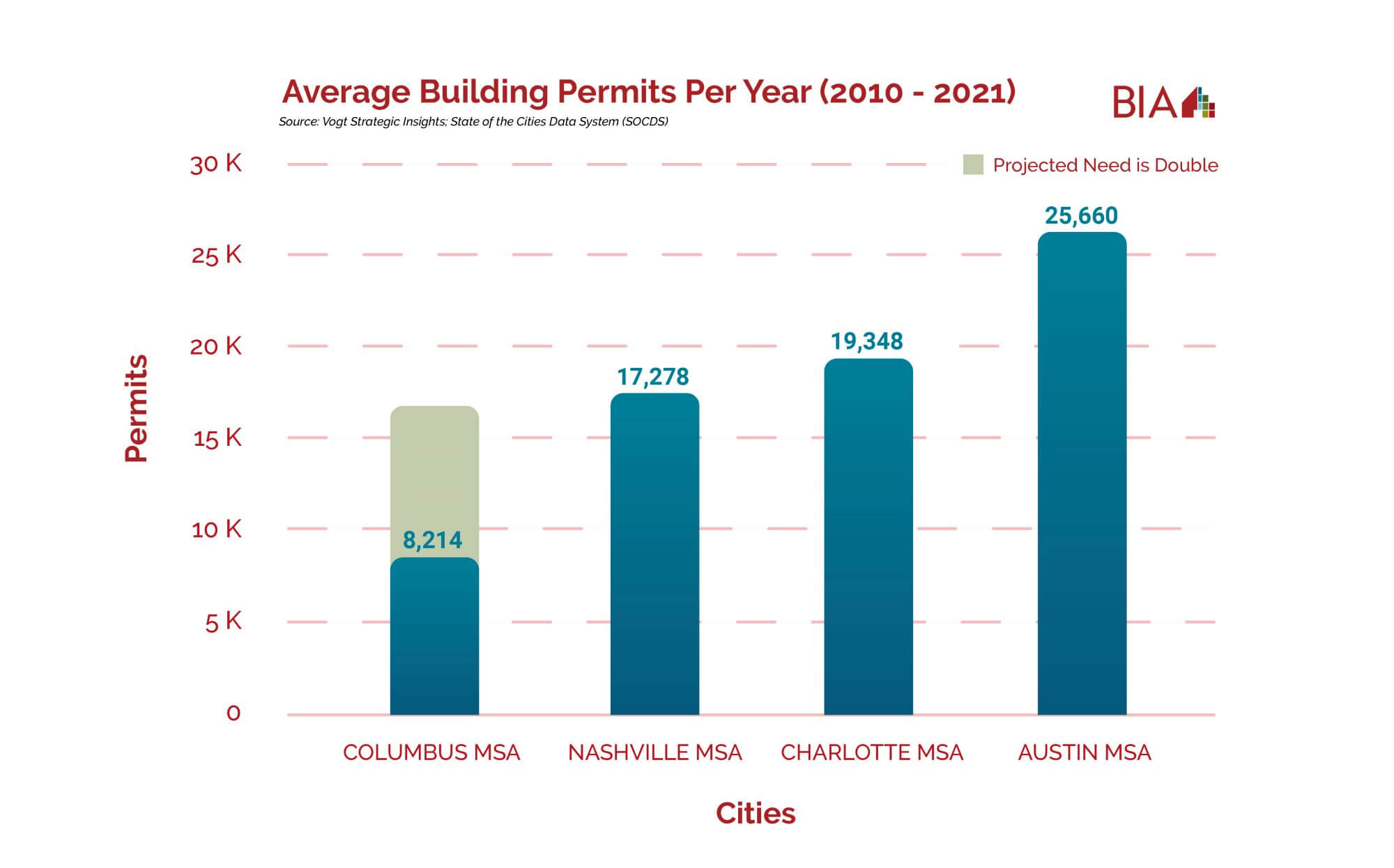

Building Permit Trends: Historical building permit activity is insufficient to meet future housing needs.

Source: Vogt Strategic Insights, State of the Cities Data System

- The region averaged 10,535 permits annually from 1990 to 2021 and 8,327 from 2010 to 2021.

- Job growth projections indicate a need for 14,535 to 20,281 new jobs annually through 2032, requiring a two-fold increase in permitting activity.

Affordability Challenges: Home prices are growing faster than median household incomes, exacerbating affordability issues.

Comparison with Peer Cities: Columbus lags behind peer cities like Austin, Charlotte, and Nashville in building permit activity.

- Factors include zoning, land availability, regulatory guidelines, construction costs, and worker availability.

To gain a deeper understanding of the critical housing challenges facing central Ohio and to access a breakdown of the data that can guide effective decision-making on zoning, land use, infrastructure, and workforce issues, we invite you to explore the full report. The insights and data within are designed to empower stakeholders to make informed choices that will shape the future of our region. Don’t miss the opportunity to learn more—download the report today.